Learn how to create and use an income statement for your business

Key Takeaways

-

Income statements show your business’s profitability and prove your revenue, expenses, and profits

-

Income statements can include sections for revenue, cost of goods sold, administrative expenses, depreciation, and other operating expenses

-

Single-step income statements typically show gross profits, profits before tax, and net profits after tax

-

Multi-step income statements also have a section for non-operating gains and losses

-

You need to provide an income statement when you apply for a loan

-

Income statements can also be a critical tool for internal decision making

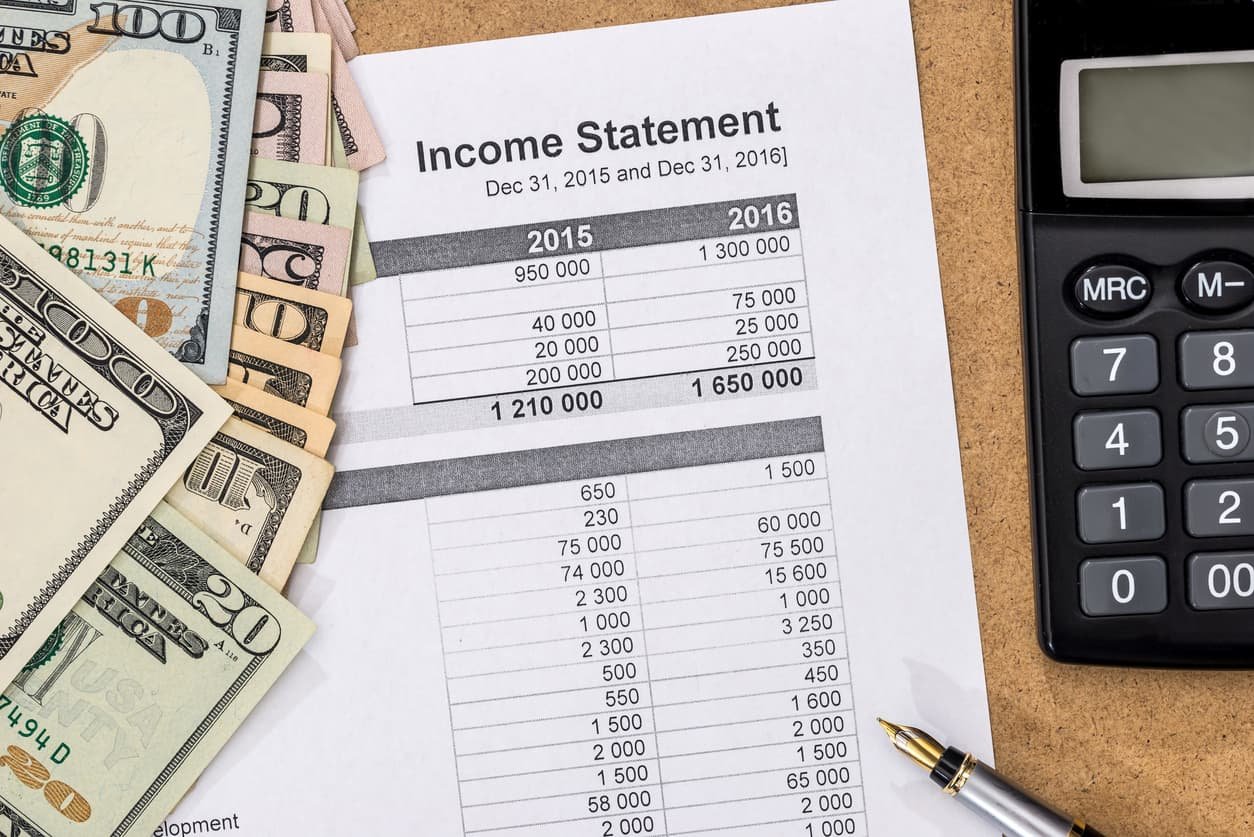

Also called a profit-and-loss statement, an income statement is one of the three most common financial statements used by businesses. These statements are critical when you are applying for a loan, pitching investors, or simply tracking the success of your business.

An income statement can help you make decisions about your business while offering third parties like lenders insight into your organization’s profitability. Whether you run a multi-national corporation or have a small freelance company, you need to understand how to generate and use income statements. Keep reading to learn more — this guide covers the essentials about income statements.

What is an income statement?

As indicated by the name, an income statement displays the income your business has earned in a particular period of time. The top of the statement shows your revenue followed by expenses and then income tax. Finally, your net income appears at the bottom of the statement.

What is on an income statement?

Income statements summarize your business’s earnings and expenses over a certain period of time. It doesn’t display each individual transaction. Instead, it reflects the total revenue and expenses in a few different categories. The exact categories vary based on the type of business. For example, a company that sells products will have a section for costs of goods sold (COGS), but a service-based company may not have that section.

Here are some of the most common categories that appear on income statements:

-

Revenue: This is the amount you earn from sales. If someone pays you $1,000, that amount goes here.

-

COGS: These are the expenses directly related to your products. If you run a clothing boutique, the amount you spend buying your inventory makes up your COGS. If you produce products in a factory, COGS might include both material and direct factory labor.

-

Gross profit: The difference between COGS and revenue is your gross profit. However, this is not the profit for your business. You still have a few more expenses to account for.

-

Advertising and promotions: Any money spent to advertise your business goes into this section.

-

General and administrative expenses: This relatively broad category includes administrative expenses such as office rent, administrative salaries, and office supplies.

-

Depreciation expenses: When you make capital purchases such as vehicles or equipment, you claim a portion of their value on your income statement every year. You don’t note the entire expense in the year of purchase. For example, if you purchase a building for $390,000, you will depreciate about $10,000 every year for 39 years. Note these are just sample numbers.

-

Earnings before tax: This shows how much your business earned before tax. It’s the difference between your revenue and all the other expenses noted above as well as any other expense categories you may decide to include on your income statement.

-

Income tax: Next, your income statement shows the income tax that your business incurred during the period.

-

Net income: Finally, at the very end of the statement, you have your net income.

All the numbers on the statement are important, but the net income number is the most important. It meshes all of your other numbers together and shows you if your business is profitable or not.

Single- versus multi-step income statements

Income statements can be either single- or multi-step. Most small businesses use single-step income statements. These include all of the elements these businesses need to track. As outlined above, a single-step income statement reflects your revenue, expenses, and net income.

To determine net income on a single-step income statement, use this formula:

Net income = (revenue + gains) – (expenses + losses)

A multi-step income statement features different sections for operating and non-operating revenue and expenses. This setup appeals to large manufacturers, retailers, and other businesses with complex business operations. It uses a slightly more complicated formula to get to net profits.

A multi-step income statement starts with revenue, COGS, and gross profit. Then, it outlines selling, administrative, and other operational expenses.

The formulas used in a multi-step income statement include the following:

Net sales – COGS = gross profit

Gross profit – operating expenses = operating income

Non-operating gains – non-operating losses = operating items

Operating income + non-operating items = net income

The main difference is that the multi-step statement has a section for all of the non-operating income and expenses for the company. This section includes elements such as investments the company made that are not part of its core operations. It can also include elements such as insurance compensation or lawsuit claims.

How to create an income statement

To create an income statement, you first need to choose the reporting period. Do you want to see your income in a certain month, over a quarter, or during a fiscal year? Then, you need to calculate your revenue and expenses. Ideally, you should have these numbers in a spreadsheet or bookkeeping software.

Then, you simply enter revenue and expenses and calculate the different types of profit as explained above. There are free templates online that you can fill out with these numbers. Or, if you have accounting software, you can generate an income statement in the reports center of the software.

An income statement provides a critical look at the health of your business. Regardless of the type or size of business you run, you will need to generate an income statement at some point. Ideally, you should use income statements on a regular basis to help with decision-making.

Contact Franco Blueprint for help with accounting

At Franco Blueprint, we provide bookkeeping, accounting, and financial guidance for a wide range of small businesses. We can help you track the numbers so you can generate an accurate income statement. We can also guide you through choosing and implementing accounting software, so you can easily create your own income statements.

We can also offer assistance with many other accounting needs. To learn more, contact us at Franco Blueprint today.